When it comes to planning for retirement, there are a number of risks to consider, including market crashes, inflation eating into your savings, outliving your savings, and even leaving substantial assets at the end of life.

But there’s another risk that’s often overlooked and that receives far less attention – sequence of returns risk.

The timing of market fluctuations matters when it comes to your retirement planning. This risk isn’t about the overall performance of your investments but the order in which those returns occur.

Early market declines can seriously impact the longevity of your retirement savings. We’ll explore how the sequence of returns risk works and how it can impact your portfolio. We’ll also look at some strategies to mitigate this risk so your investment portfolio is able to meet your retirement term goals.

Understanding Sequence of Returns Risk

Sequence of returns risk, also known as sequence risk, is a real risk when it comes to your retirement income planning. It’s the risk that negative or poor market returns, occurring either late in your working years or early in retirement, can impact your portfolio and your overall retirement strategy.

Your retirement portfolio is meant to be dynamic and should provide you with both income and growth over time. Ideally, it should be replenishing itself as you withdraw funds.

Even if the average returns over your retirement period meet your expectations, having a major market downturn in the early years of your retirement can impact your retirement. That’s because when you withdraw funds during a period of falling returns, you’re forced to sell more assets to reach your target withdrawal amount.

This depletes your savings faster and lowers the potential for future growth and recovery, which is especially damaging for an early retiree’s portfolio.

But if you face a market decline later in on your retirement, when you may have fewer years left to fund, the impact is less severe. In this case, you may not need your portfolio to grow as much, which makes it easier to manage your withdrawals.

The Impact of Sequence of Returns Risk

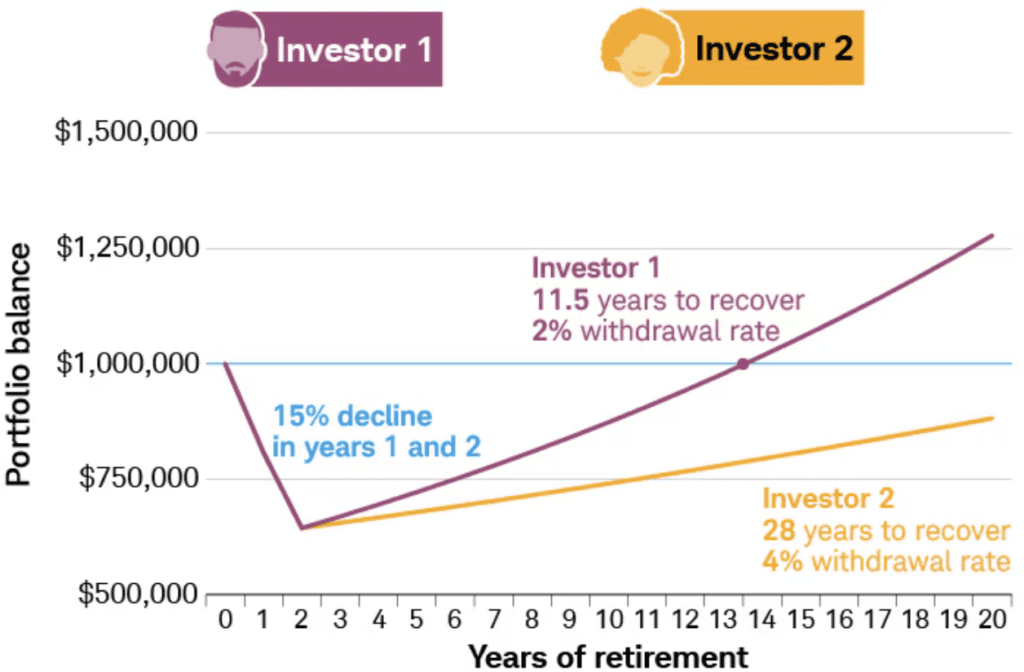

Let’s look at a hypothetical scenario. The chart below shows the impact of a 15% market decline for two investors, each starting with a $1 million portfolio.

Each investor withdraws $50,000 from their portfolio annually.

Investor 1 experiences a 15% market decline in the first two years of their retirement. Investor 2 faces the same market decline of 15% but in the 10th and 11th years of their retirement.

Source: Schwab Center for Financial Research

A market downturn early in retirement can have a more severe impact on an investor’s financial security compared to experiencing the same downturn later in retirement.

This is because early losses reduce your overall portfolio value, which leads to smaller withdrawals in subsequent years. This can create a cycle of reduced returns, lower spending power, and increase the risk of draining your retirement funds early.

While the stock market has historically outperformed other asset classes over the long term, its year-to-year performance is unpredictable. We can’t predict which years we’ll see market declines, but history shows that negative returns have occurred about 25% of the time since 2000.

This means there’s a real risk that your retirement year could coincide with a down market.

Source: S&P Dow Jones Indices. Data through Dec. 31, 2023

How Early Returns Impact Your Retirement Savings

Now let’s look at a hypothetical scenario of two retirees – Keith and Lisa, and compare their returns over a five year period.

| Year | Keith’s Returns | Lisa’s Returns |

| Year 1 | 25% | -20% |

| Year 2 | 15% | -5% |

| Year 3 | 5% | 5% |

| Year 4 | -5% | 15% |

| Year 5 | -20% | 25% |

We see that Keith and Lisa both experience the same annual returns – except the orders are reversed. Notice that Keith’s portfolio starts strong with gains early on, followed by weaker returns later.

Lisa’s portfolio is the opposite. She experiences weaker returns early on, followed by stronger returns later.

Assume they each started with $100,000 and invested it over five years and didn’t make any contributions or withdrawals. Each would have the same ending balance of $114,712, which is an average annualized return of 2.7%.

But the picture changes drastically when we factor in any contributions or withdrawals.

Let’s assume that Keith and Lisa each contribute $10,000 annually to their $100,000 portfolios at the beginning of each year, and compare their outcomes:

- Keith: A $10,000 annual contribution at the beginning of each year leads to a final balance of nearly $159,000, with an average annualized return of 7.6%.

- Lisa: The same $10,000 annual contribution at the beginning of each year leads to a larger final balance of over $182,000, with an average annualized return of 10.6%.

Now, let’s assume instead of contributing to their portfolios, they each take a withdrawal of $10,000 from their $100,000 portfolios at the beginning of every year:

- Keith: A $10,000 annual withdrawal at the beginning of each year leaves him a final balance of over $70,000, with an average annualized return of -4.7%.

- Lisa: The same annual withdrawals at the beginning of each year leave her with a much lower final balance of just under $47,000, with an average annualized return of -12.2%.

The sequence of returns, especially when considering contributions or withdrawals, hugely influences the overall outcome of your portfolio.

Ways to Manage Sequence of Returns Risk

Now that we know what sequences of returns risk are let’s look at a few strategies to consider in managing this risk:

- Start with the 4% rule

- Keep a reserve portion in your portfolio

- Use dynamic spending rules

- Use a retirement bucket strategy

- Reduce spending

- Start with the 4% rule

You may have heard of the 4% rule, which has become a popular guideline for retirement withdrawals. This rule originated from a 1994 study by financial advisor William Bengen. Bengen wanted to determine a safe initial withdrawal rate based on historical market conditions and inflation rates.

He analyzed retirement portfolio withdrawals starting in each year from 1926 to 1976 and concluded that an initial withdrawal rate of 4% of a portfolio, adjusted for inflation annually, could provide at least 30 years of income.

The 4% rule has been widely used by financial advisors, but it has its limitations. Many retirees may find it challenging to cover their living expenses with an initial withdrawal rate of only 4%, especially today, in a higher inflation environment.

Another risk of this 4% withdrawal rule which isn’t talked about much, is that you could potentially leave too much in assets at the end of life.

Michael Kitces, a popular financial planner, has observed that following the 4% rule can lead to two equally likely outcomes: either ending retirement with your initial principal or having six times more money than you started with. Some of the challenges that come with these outcomes include:

- Tax Implications: A large remaining balance could lead to higher tax liabilities, especially if it’s invested in taxable accounts.

- Investment Management: Managing a substantial portfolio can be complex and time consuming, especially in retirement.

- Spending Habits: Having a large nest egg could encourage overspending.

Though the 4% rule has had an overall strong track record, it may not be a one-size-fits-all solution.

-

Keep a reserve portion in your portfolio

Another strategy to mitigate sequence of returns risk is to maintain a short term reserve of low risk, liquid investments. This reserve can be used to cover expenses during market downturns, so you can avoid selling stocks at depressed prices.

To make sure you have sufficient liquidity, set aside assets to meet your income needs for the first three to five years of retirement. This portion of your portfolio should be held in more liquid assets with little exposure to market fluctuations, such as cash equivalents such as money market funds and short term bonds.

You can also consider holding an additional two to four years’ worth of expenses in high-quality short term bonds or bond funds. Currently, US Treasury bond yields are the most attractive they’ve been in many years, with short term Treasury Bills and 1 and 2 year Treasury notes yielding 5.0% or higher.

Having a portion of your portfolio allocated to cash, cash investments, and short term bonds can serve as the “conservative” portion of your portfolio, while you can hold a larger portion of your portfolio in higher growth assets such as stocks.

3. Use dynamic spending rules

Your budget in retirement will be different than your budget while you’re working. Your budget while working typically has a higher proportion of fixed expenses like housing and childcare, while retirement budgets tend to have a larger portion for discretionary spending, such as travel and hobbies.

Dynamic spending involves adjusting your annual spending based on your portfolio’s performance. With this approach, you’ll first establish some spending rules.

These rules allow for increased spending during good market years and reduced spending during poor market years. These adjustments don’t need to be drastic. These also tend to be easier to implement in retirement as you have a higher proportion of your budget allocated to discretionary spending.

In “Dynamic Retirement Spending: A Framework for Success”, Vanguard research concluded that dynamic spending rules could improve the odds of retirement success. They tested a distribution strategy that involved a percentage withdrawal of the previous year’s portfolio value, with adjustments based on specific rules.

With dynamic spending rules, you adjust annual withdrawals based on market performance and inflation, allowing for higher withdrawals during strong market periods and lower withdrawals during downturns.

Vanguard found this approach helped to mitigate sequence of returns risk and inflation risk while also potentially extending the life of your retirement funds.

For example, with a $1 million portfolio and using the 4% withdrawal rate rule, your initial distribution would be $40,000.

The following year, a ceiling of $42,000 (5% above) and a floor of $39,000 (2.5% below) would be set. If your portfolio grows to $1.1 million, the 4% withdrawal would normally be $44,000, but the distribution would be capped at a ceiling of $42,000.

On the other hand, if your portfolio had a 10% decline and dropped to $900,000, the 4% withdrawal amount would normally be $36,000, but the distribution would be increased to the floor of $39,000.

This approach allows for spending to increase when markets are strong and decrease during downturns, with pre-determined ceilings and floors to prevent overspending or underspending.

Vanguard recommended that a well diversified portfolio should also be used. Additionally, these spending rules are more effective for those with longer retirement horizons.

With this strategy, you can think of this as giving yourself a raise during good times and a pay cut during bad times, though you’re limiting each by predetermined amounts. The specific rules should be tailored to your circumstances, risk tolerance, and financial goals.

4. Use a retirement bucket strategy

The retirement bucket strategy is another approach to managing sequence of returns risk. Essentially, it involves dividing your assets into three main buckets:

- Immediate Needs: This bucket covers your essential living expenses like groceries, utilities, and housing costs. It’s recommended to hold enough cash or cash equivalents to cover 1 to 2 years of essential expenses so you don’t need to sell investments during market downturns.

- Short Term Savings Goals: This bucket covers your non essential expenses or unforeseen needs, such as a new car, a luxury vacation, or unexpected medical costs. It’s typically funded with investments like money market accounts, and short term fixed income investments or certificates of deposit (CDs).

- Long Term Planning: This bucket covers your long term goals, like leaving a legacy or funding long term care. Since these funds won’t be needed immediately, they can be invested in the stock market and other higher risk assets for growth.

With these three buckets set up, you can prioritize your spending based on your immediate needs while also making sure you have funds available for future goals.

Another benefit is that it can also help in reducing the psychological stress of market volatility. However, this strategy has some shortcomings, which are:

Oversimplification

The strategy assumes a clear cut separation between the buckets, though major market fluctuations can blur these lines. A downturn in the “long term planning” bucket could impact how you access funds for your “short term savings goals” if you need them sooner than expected.

Also, if you have significant medical expenses, you’ll likely need a more nuanced approach to managing your “immediate needs” bucket.

Potential for Misallocation

The strategy doesn’t address individual risk tolerance in a sophisticated way. Someone with a low risk tolerance might not be comfortable allocating a large portion of their portfolio to the “long-term planning” bucket, even if it’s for a distant goal.

Also, this strategy doesn’t account for changes in your investment horizon. For instance, as you age, your investment horizon shortens, and you may need to adjust your investment asset allocation accordingly.

Lack of Flexibility

The strategy is pretty inflexible when it comes to unexpected events, such as a spouse’s job loss or a major health issue. You might need to access funds from a different bucket than you planned, which could then impact your long term goals.

5. Reduce spending

Lastly, If you find yourself facing a market downturn without a large reserve of liquid assets available to withdraw from, you may need to just scale back your spending and portfolio withdrawals.

The chart below illustrates the impact of reducing withdrawal rates after a market downturn. Two investors, each starting with a $1 million portfolio and initially withdrawing $50,000, experience a 15% market drop in the first two years of retirement. During the first two years, they each withdraw $50,000 annually.

From year three onwards, both portfolios see a consistent 6% annual growth. However, Investor 1 maintains a withdrawal rate of 2% per year, while Investor 2 maintains a 4% withdrawal rate per year.

Source: Schwab Center for Financial Research

Investor 1, with a 2% withdrawal rate, would require about 11.5 years of consecutive 6% annual gains to fully recover from a market downturn. In contrast, Investor 2, with a 4% withdrawal rate, would need a much longer period of 28 consecutive years of 6% annual gains to achieve the same recovery.

Even with a recovering market, making consistent withdrawals acts as a heavy drag on your portfolio. During a downturn, more shares need to be sold to maintain the same spending level compared to periods of growth. This gets amplified with a higher withdrawal rate.

Your goal should be to hold onto your investments during market downturns. Doing this helps you avoid locking in losses and allows you to benefit from the market’s historical tendency to recover and grow over time.

Final Thoughts

Market downturns are an inherent part of investing, and while they’re a normal occurrence, they can be especially painful for retirees who rely on their investments for income and for early retirees.

The Great Financial Crisis of 2008 is a painful reminder of this. During this period, many retirees saw a massive decline in their investment portfolios, with some even exceeding 50%.

Retirement planning shouldn’t be a one time exercise but an ongoing and iterative process. The above strategies highlight the importance of knowing how to manage sequence of returns risk so you have a better chance of achieving retirement success.

UPCOMING WEBINAR

From Our Friends at Earned Wealth

Tired of long hours and endless paperwork? Want to find out how your wealth works for you, not the other way around.

Join Physician on Fire and Earned for an exclusive webinar that will transform your financial future.

Don’t miss this opportunity to learn from the experts who have helped thousands of doctors achieve financial freedom.

Register now for FREE and take the first step towards a life of financial independence.

When: June 18, 12 pm ET/9 am PT