In 2024, I made my 12th pair of “backdoor Roth” IRA contributions with Vanguard. It’s a great way for high-income professionals to contribute to a Roth IRA when earning “too much” to contribute directly to a Roth IRA. I do this annually for both my wife’s mutual fund IRA account and my brokerage IRA account, and I’ll highlight the differences in the processes below. Not much has changed for the legacy mutual fund IRA account, but the screenshots look a lot different for those of us who transitioned to (or started with) brokerage IRA accounts.

This post will give you a brief overview of the backdoor Roth, precise step-by-step instructions on how to do this yourself at Vanguard, and you can visit the backdoor Roth FAQ that should answer any lingering questions you have.

I transitioned to a “brokerage IRA account” as requested by Vanguard a few years back, while my wife’s account remains a “mutual fund IRA account.” The latter makes things quicker and easier, although now, there only seems to be a one-day difference between the two different processes for the different account types.* In 2024, Step 1 was nearly identical for the two account types. Step 2 was different, and only a brokerage IRA account requires Step 3 (invest the money), which is done automatically as part of Step 2 with a mutual fund IRA account.

I like to get our backdoor Roth contributions and conversions done early in the year to start the tax-free earnings as soon as possible, but you have until Tax Day in mid-April, 2024 to complete a 2023 Backdoor Roth contribution (and until April, 2025 to make your 2024 contribution).

Vanguard is the company I use, and it’s one that tends to be favored among many index fund investors, so that’s what you’ll see here. The process should be similar with other brokerages, but the screenshots will obviously look different. You can check out our Fidelity Backdoor Roth guide if you’re with Fidelity.

Backdoor Roth IRA: An Overview

Money contributed to Roth accounts does not result in a tax deduction, unlike contributions to tax-deferred accounts. Both Roth and tax-deferred accounts benefit from tax-free growth, unlike a taxable account that is subject to tax drag (which can be minimized). The Roth dollars, unlike tax-deferred dollars, will not be taxed when withdrawn.

One of the first world problems of earning a solid income is the inability to contribute directly to a Roth IRA or a tax-deductible IRA.

A modified adjusted gross income (MAGI) of $240,000 for a couple filing jointly, or $161,000 for an individual makes you ineligible to contribute to a Roth IRA in 2024. Phaseout ranges where you can make a smaller Roth contribution (less than $7,000) start at $230,000 and $146,000 for couples who are married filing jointly and single filers, respectively.

Many physicians are thus excluded from making either deductible IRA contributions or direct Roth IRA contributions.

If there’s even a tiny chance your income might put you into or above those phaseout ranges, you’re better off using the backdoor, just in case. There’s nothing wrong with making your Roth contribution the hard way and finding out later that you didn’t need to take the extra steps. You won’t have to change a thing.

Now, understand that a high income doesn’t mean you can’t contribute directly to a Roth account of some kind. You may have a Roth option within your 401(k) or similar account, although I would argue you’re probably better off with the tax deduction offered by making tax-deferred 401(k) contributions if you’re in the 32% or higher tax bracket.

Another important distinction is that a high income does not currently prevent you from making Roth conversions. The income limits were lifted in 2010, and I took advantage by making a Mega Roth conversion when it was believed the income limits would be reinstated. However, there are still no income limits, and hence, the backdoor remains wide open.

The income limits for the ability to make a traditional tax-deferred IRA contribution are even lower than the Roth contribution limits. If you participate in a workplace retirement plan, you won’t be eligible to contribute as an individual earning more than $87,000 or as a couple earning more than $143,000 in 2023. The deduction actually begins to phase out at a MAGI of $77,000 for single filers and $123,000 for married couples filing jointly.

Physicians and pharmacists, Register with Incrowd for the opportunity to earn easy money with quick "microsurveys" tailored to your specialty.

Before Attempting a Backdoor Roth

While income limits are a non-issue for the backdoor, there exists one important prerequisite to be able to properly execute the backdoor Roth.

You cannot have tax-deferred money in a traditional IRA, SEP IRA, or SIMPLE IRA in your name.

The list includes traditional IRA, SEP IRA, and SIMPLE IRA, but does not include 401(k), 403(b) or similar accounts. If you do hold tax-deferred IRA dollars on 12/31 of the calendar year in which you made the Roth conversion, you’ll be subject to taxes when making your conversion per the pro-rata rule.

If you do have these types of accounts, you’re not hosed, but you need to have a strategy to move that money elsewhere or you can forget about the backdoor Roth. Note that inherited IRAs are a non-issue.

If the balances in your IRA or IRAs are small and you can afford the taxes on the conversion, you can convert it all to Roth and just pay tax on the conversion. This could be a good idea for those in lower tax brackets — residents and students, for example.

Another option for employees may be to roll the IRA into an employer’s 401(k) plan. Not all plans accept rollovers, but mine does, and this was the route I chose with my SEP-IRA a few years ago. Fortunately, my 401(k) offers institutional Vanguard index funds. If I had lousy options, a rollover might not have been worthwhile.

It might also a good idea to avoid having a SEP IRA in the first place by putting your independent contractor earnings into a solo 401(k) instead. The White Coat Investor covers some of the advantages in this article.

One way employees without a business of their own create one is by obtaining an EIN for a survey-answering business. Earning just a little 1099 money on the side qualifies you as a business owner, and you can open an individual 401(k) a.k.a. solo 401(k) for the business.

As long as the plan accepts rollovers (many do), you’ll be able to roll over traditional IRA, SEP and SIMPLE IRA money into it to circumvent the pro-rata rule and associated taxation when attempting the backdoor Roth.

For healthcare professionals, I’ve found that the simplest side business is one in which you answer medical surveys for dollars. I’ve got a great overview of a handful of survey companies here.

Completing the backdoor Roth with Vanguard:

If you haven’t done so already, you’ll need to open a Traditional IRA and a Roth IRA. I won’t walk through all the steps, but it should be straightforward. Go to the Vanguard homepage and select “Personal Investors” under “OUR SITES“.

Tell Vanguard that, yes, you’d like to start on that page whenever you go to Vanguard.com, and click on “Open an account”.

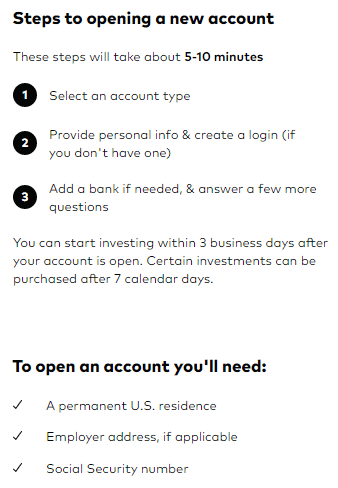

Next, you’ll be taken to a screen with an explanation of what you’ll need, how long it will take, and there are video walkthroughs to make it really simple.

Since I opened my accounts years ago, I start the backdoor Roth process by making a contribution to my existing traditional IRA, an account that Vanguard thankfully leaves open, even when the balance is zero, which it is about 364 days of the year.

Backdoor Roth Step 1: Make a Non-Deductible IRA Contribution

Vanguard offers two IRA account types: mutual fund and brokerage. As requested by Vanguard, I transitioned my IRA to a brokerage variety, whereas my wife’s IRA is still a mutual fund account. The first step is essentially the same for both, which you’ll see below. The later steps differ, and I’ll show the screenshots for each, as they are quite a bit different.

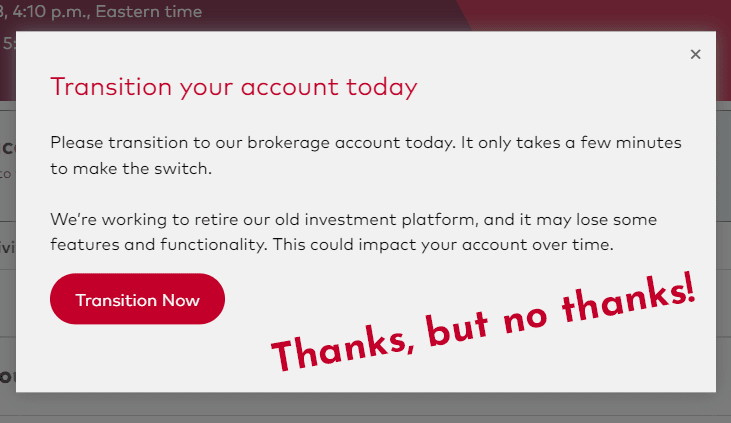

After logging in to Vanguard, I can access the Traditional IRA from the Dashboard. Select the account by clicking on it. You can tell this is the mutual fund Traditi0nal IRA Account by the “Transition This Account” invitation, which can safely be ignored.

If you’ve been doing the backdoor Roth as we teach it, this will have a zero balance.

Within your Traditional IRA account, click the three dots to the right of “Transact” and select “Contribute to IRA“.

If you have a mutual fund IRA account, you’ll choose from fewer options, but there’s no other difference. Select “Contribute to IRA” just as above. I’d ignore that “Transition this account” button unless they’ve threatened to start charging you $20 a year for failing to transition, which I’ve heard they’ve done for some users.

Vanguard asks if it’s a rollover from another tax-deferred account. It’s not. Select “no“.

Towards the bottom, you’ll choose the YEAR for which you want this contribution to count. This is a 2024 backdoor Roth tutorial, so I put the $7,000 into the 2024 column. Note that $7,000 is $500 more than you could contribute in 2023 and $1,000 more than the maximum 2022 contribution. If you’re 50 or older, you can now contribute $8,000.

Since I already made a 2023 contribution of $6,500, that text entry field is unavailable to me, and for good reason. If you have not yet made a 2023 contribution, you can do so until Tax Day in mid-April of 2024. And you have until mid-April of 2024 to make your contribution for 2024.

If you’ve not done it for either year, and you’ve got the money, you could contribute for both years right now.

Once you’ve chosen how much you’re contributing and for which year, click “Continue” to tell Vanguard where the money is coming from. You’ll have several options. I’ve contributed from a Vanguard taxable brokerage account and from connected checking or savings accounts. In my experience, the source didn’t seem to impact the timing of the money becoming available for conversion.

Next, you may be asked to consent to electronic delivery of fund prospectus. If you haven’t gone paperless, you may not see this option. If you do, click “ACCEPT” and move on.

You’ll be asked to review and submit your IRA contribution. If it looks good and has the correct contribution year, go ahead and click “SUBMIT“.

You’ll get a confirmation and a polite “Thank you” from your friends at Vanguard. Note that in the lower left, you’re told that you have $7,000 in funds available to trade. This isn’t exactly true. It will likely be another business day or two before you can convert that money.

I will break the remaining steps into two distinct tutorials: one for a brokerage IRA account (all newer accounts) and a second for older mutual fund accounts that have not transitioned.

Note that you will likely be harassed to transition. I politely decline every time by clicking the little “x” in the upper-right-hand corner.

Brokerage Account Backdoor Roth Step 2: Convert to Roth IRA

Before the Tax Cuts and Jobs Act went into effect in 2018, some people worried about something called the “step doctrine” and that it may be best to wait a while before making the Roth IRA conversion.

This theoretical concern was put to rest with footnotes 268, 269, 276 and 277 of the Conference Committee’s explanatory report on the Tax Cuts and Jobs Act that provided clarity and validated the backdoor Roth IRA contribution.

As I’ve always done, I convert as soon as Vanguard will let me. Now I do so with zero concerns about the step doctrine.

If you try to convert the same day, however, you’ll hit a roadblock. “This account has no holdings avaiable to convert” despite the displayed balance of $7,000. Typically, it’s not the next day, but the second business day after the contribution that you’re able to convert, at least when funding with a bank account. Using money parked in a Vanguard money market or cash account may save you one day.

Once your IRA shows “Funds available to trade“, go ahead and click that oval saying “Convert to Roth IRA.” There’s a great big warning box stating that I cannot buy stocks, bonds, CDs, or non-Vanguard funds for 7 days. No worries, I’m going to purchase a Vanguard mutual fund. I could also purchase Vanguard ETF with no waiting period.

Next, you’ll see a couple of screens with a pleasing seafoam background warning you about the possibility of a Roth conversion being taxable. In our case, it won’t be. Note that the only thing that makes your traditional IRA contribution non-deductible is what you report to the IRS. Vanguard doesn’t know what your 1040 looks like. Form 8606 becomes important at tax time, but there’s no checkbox at Vanguard to indicate that you won’t be deducting this contribution.

Agree and proceed.

After looking this next screen over, continue.

You’ll be asked if you want to convert some or all of your Traditional IRA to Roth. Typically, you’ll want to convert all of it, assuming you started the process with a zero or near-zero balance. If there are a few dollars of interest in the account, just convert it all. It might cost you a buck or two when you file taxes next year.

If you have tens of thousands of dollars in the IRA, you are going to have an issue with the pro rata rule. Hopefully you figured that out when reading the introduction to this article; if you didn’t, consult with your CPA as what would be best in your particular situation.

Next, select the Roth IRA where the funds will end up. It can be the same Roth IRA you’ve been using for years. It can have a zero balance if you just opened it, or it may have a five-figure or six-figure balance if you’ve had it for some time. Bonus points for those of you with a seven-figure Roth IRA. You’re crushing it!

When you continue, you’ll have yet another chance to agree with the fact that the conversion could be taxable if you weren’t doing a proper backdoor Roth, and to review and submit. When you’ve done so, you’ll get a confirmation that your conversion has been initiated. I was concerned by the language on the right that I might have to wait another couple of days to invest the money, but I was able to make an investment selection immediately upon finishing this step.

In the next step, we’ll invest that money. If for some odd reason, you plan to leave the money in a money market fund, you can be done. But that would be silly.

Brokerage Account Backdoor Roth Step 3: Invest in the Roth IRA

Do not forget to invest the money you converted to your Roth IRA! It’s part of the conversion process when using a mutual fund IRA account, but not when using a brokerage IRA account.

When your account shows the $7,000 or more as an “Available balance“, it’s time to invest that money. I had $48.91 sitting in my settlement fund, so I chose to invest that, too. Once again, I can ignore the “Unavailable shares” warning, and it doesn’t apply to me, and it won’t apply to you if you’re planning to invest in a Vanguard mutual fund or ETF.

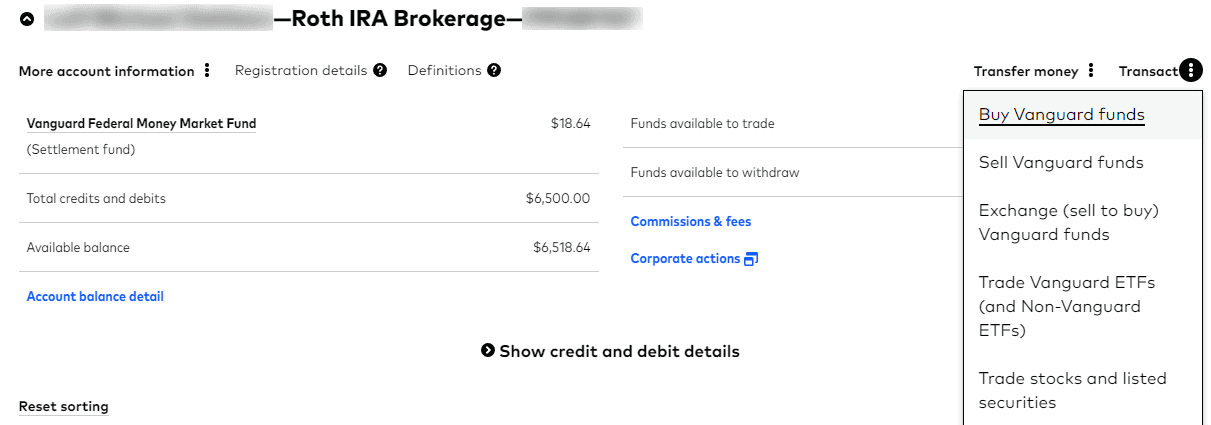

Click “Transact” on the right and select the top option, “Buy Vanguard funds.”

I’m given the option to either put more money into one of the three holdings I currently have or search for a new fund. I know from my portfolio tracking spreadsheet that I’m a bit underweight in international stocks, so that’s where I’ll invest this money, in VTIAX. I click the “Buy” button in the lower right.

On the next screen, I choose the dollar amount to buy, which is equal to my “Funds available to trade” and then click “Continue order“.

On the next screen Vanguard advises me that I cannot contribute directly to the Roth IRA because I’ve already maxed out my 2024 contribution. It’s perfectly acceptable to use my settlement fund to make the purchase, which is what I was planning on doing, of course. I wouldn’t be going to all this trouble if I was legally able to contribute directly to the Roth IRA!

One last screen to review, and we’re able to “Submit Order“.

Finally, your order is submitted. Now it’s time to either repeat the process for a spouse or forget about it until this time next year when you’ll return to this page like you’ve been doing for so many years.

Uff da! That was a lot of screens to click through, but it’s not as complicated as it appears. Still, I always come back to this post to do my own backdoor Roth each year. The screenshots change a bit each year, more in some years than others, but the actual process remains the same.

If you need instructions for a mutual fund account, those screenshots are up next. If not, jump to the end for information on spousal IRAs, how to report this at tax time, an estimation of the value of the backdoor Roth, and a thorough FAQ.

Mutual Fund Account Backdoor Roth Step 2: Convert to Roth IRA & Invest

Once your mutual fund Traditional IRA account shows a $7,000 balance (this was on 1/4/2023 for me), you’re ready to convert that money to a Roth IRA. However, unlike you will see with a brokerage account IRA, there’s no “Convert to Roth” button.

Instead, you’re going to “exchange” to a Roth IRA, so go ahead and select the three dots next to “Transact” and select “Exchange (sell to buy) Vanguard funds.”

In the next screen, which should look familiar, select the fund with your IRA contribution and click “Sell all shares” on the left. On the right, you’ll tell Vanguard that the money is going into your Roth IRA.

You’ll be investing simultaneously, and you’ll select which fund gets the $7,000 on the right. My wife’s Roth IRA only has one fund, so her REIT fund gets 100% of the Roth conversion money.

You’ll notice an “Alert” in the screenshot above and several others that follow warning me that my $7,000 hasn’t cleared the bank. I’m making the conversion about 18 hours after the contribution on the next business day. The funds had already been withdrawn from my bank account, and the conversion does indeed go through without a hitch, despite these repeated warnings.

Since this is a non-deductible contribution, we won’t owe any tax on the conversion, assuming you followed the directions and put your contribution into a money market fund and converted as soon as possible.

If you waited a while or chose a more volatile fund, you could have some dollars in earnings. If so, convert it all, and you may owe a few dollars in taxes, but not enough to make withholding necessary.

You’ll once again be asked to accept an electronic fund prospectus, and you’ll be reminded that “A conversion is a taxable event and can’t be changed.” However, it does go on to say that it’s generally true, but if you’ve made a non-deductible contribution (which you have), you may be taxed on only a portion of the contribution (the earnings). No earnings, no tax.

Next, you may see a yellow warning that a conversion can’t be reversed. That’s fine; we know what we’re doing.

Now, you’ll see the screen that shows your new withholding choice of 0%. Check the box next to “Do not send a tax withholding notice” if it’s not already checked by default. New in 2024 was a section for state tax withholding. You presumably won’t see this if your state of residence has no state income tax.

Review the information and submit if you’re happy with what you see.

Finally, you’ll see a confirmation screen similar to the review screen. Your Roth conversion is complete, and your money will be invested in the fund you chose.

Spousal Roth IRA

If you’re married, your spouse can also do the backdoor Roth, even if he or she has no earned income.

You must have at least $14,000 of earned income between the two of you (or $15,000 or $16,000 if one or both of you is at least 50 years old), but all of the income can come from one person.

Note that for pro rata rule issues, your IRA accounts don’t affect your spouse’s ability to do the backdoor Roth, and your spouse’s IRAs don’t affect yours.

Fill out Form 8606 in your 1040

At tax time, you will report these moves in IRS From 8606.

The IRS has instructions here and the form here. I see no need to repeat them. If you use tax software, instructions on filling them out with TurboTax and others can be found on the Backdoor Roth FAQ.

Additional Resources

If you have additional questions, your question is almost certainly among the 40+ questions answered in the all-encompassing Backdoor Roth FAQ. I strongly encourage you to check there first before asking a question below.

Looking for additional investment opportunities now that you’re maxing out your tax-advantaged space? Look to my Real Estate Investing Resources.

For more information, be sure to check out additional articles on the Backdoor Roth:

- Vanguard Backdoor Roth: a Step by Step Guide

- The Marginal Value of the Backdoor Roth. Is it Worth the Trouble?

- Calculating the Value of Your Backdoor Roth Contributions

- The Backdoor Roth Point / Counterpoint: A Must-Do or Meh?

- The Backdoor Roth FAQ

Is the Backdoor Roth Worth the Trouble?

I would say “Yes.” If you’re considering the backdoor Roth, the $7,000 or $14,000 most likely takes the place of a portion of your investments that would otherwise be invested in a taxable account.

As long as the money remains in a Roth account, it will grow without tax drag. Currently, my tax drag is nearly 0.6%, but with the right investments (index funds) and an ability to land in the 0% capital gains tax bracket in early retirement, tax drag can be quite close to zero.

Also, as a taxable account appreciates, you can end up with substantial unrealized gains, which may eventually force you into a higher tax bracket as you realize those gains to have spending money in retirement.

Clearly, Roth money is more valuable from a tax perspective than money in a taxable account. I see no reason not to take advantage of this opportunity, as long as it exists, unless you have IRA money that would subject to the pro rata rule, and no good rollover options (such as an employer’s or solo 401(k)).

Was this helpful? Please consider subscribing to this site. I’ll give you a spreadsheet full of useful and fun (yes, I said spreadsheet and fun in the same sentence) calculators, and you’ll know when new posts are published.

Have you taken advantage of the backdoor Roth? What’s holding you back? Don’t forget to view the Backdoor Roth FAQ!

686 thoughts on “Backdoor Roth IRA 2024: A Step by Step Guide with Vanguard”

Another year, another Backdoor Roth IRA completed with your help. Thanks for keeping this guide up to date!

Hello , Thank you for the post and I did follow these steps for 2023. Need a help! Appreciate your reply!

I incurred 12$ interest in trad IRA by the time I converted all amount to Roth IRA. I am filing out the NJ state tax in turbox tax and where I need to report this conversion. Two questions asked in Turbo. Should I enter like this:

Value of Account on Date of Distribution : 6512$

Contributions Related to This Distribution Previously Taxed by New Jersey : 6500 $

Is this correct? This 2nd question explanation says as below in Turbo. . Is it saying to report only if I had been taxed in 2022?

Enter contributions to the traditional IRA being converted to a Roth IRA that were previously taxed.

If you do not already have a worksheet determining the previously taxed portion of this IRA distribution to Roth IRA conversion, you can use a variation of the IRA Worksheet for each Roth IRA conversion:

A. Determine the total amount of withdrawal(s) made from this IRA in previous years.

B. Total the portion(s) of these previous year withdrawal(s) already reported as income on prior New Jersey tax returns.

C. Subtract the amount of previous year withdrawals reported (on line B) from the total amount of previous year withdrawals (on line A). This difference is the amount of contributions that have been recovered from this IRA account so far.

(blah blah blah…)

Didn’t see the update for 2024

Looking for the same – any changes for 2024?

Hello

in ordeder to execute any converssion you say ”

“You cannot have tax-deferred money in a traditional IRA, SEP IRA, or SIMPLE IRA in your name.’

can one convert /rollover a traditional IRA into 401k while working and getting RMD distribution?

best and health

Don

If you’re now receiving RMDs, that tells me you’re at least 72 or 73 years old in 2023.

If your 401(k) accepts rollovers, this could be a viable option, and it may allow you to reduce or prevent RMDs for a period of time, according to this article from Schwab. As always, I would check with a CPA and your 401(k) plan administrator to ensure this is a possibility.

Cheers!

-PoF

I would like to roll over the pretax money in my traditional IRA into my 403b plan. The plan administrator says that I can do this. However, my accountant is under the impression that under the IRS aggregation rule, you cannot separate pre-tax IRA funds from after tax IRA funds, so I can not roll over the pre-tax money in my IRA without also rolling over some of the after-tax money in the IRA. I am also seeing other sources that state that 403b plans can only accept rollovers of pre-tax funds, leaving only after-tax/nondeductible funds in my IRA, which is exactly what I want for the Roth conversion. Please help me here. Which source is correct?

Hi,

Thank you for your insight! I waited too long and did not contribute to my 2022 traditional IRA until last week. I wouldn’t be able to roll over to a Roth until after the tax deadline of April 18th. Would I still be able to convert my 2022 funds into a Roth, since I technically contributed to the traditional IRA before the deadline? Also, for form 8606, would I fill that out for the 2022 tax year or only 2023 since the conversion happened in 2023?

Thanks 🙂

Hi,

Thank you for your insight! I waited too long and did not contribute to my 2022 traditional IRA until last week. I wouldn’t be able to roll over to a Roth until after the tax deadline of April 18th. Would I still be able to convert my 2022 funds into a Roth, since I technically contributed to the traditional IRA before the deadline? Also, for form 8606, would I fill that out for the 2022 tax year or only 2023 since the conversion happened in 2023?

Thanks 🙂

Physicians and pharmacists, Register with Incrowd for the opportunity to earn easy money with quick "microsurveys" tailored to your specialty.

Hi,

I left this for too late. If I put money into a traditional IRA now and then convert it into a roth IRA for 2022, will it be too late? I know the money has to get into the IRA before 4/18/23 but does it have to be converted into the roth BEFORE 4/18/23 as well? Thanks! -Nicole

Hi,

I left this for too late. If I put money into a traditional IRA now and then convert it into a roth IRA for 2022, will it be too late? I know the money has to get into the IRA before 4/18/23 but does it have to be converted into the roth BEFORE 4/18/23 as well? Thanks! -Nicole

No, you’re fine. Just get the contribution in ASAP.

It’s best to convert as soon as you can to avoid taxes on any earnings, but there’s nothing that says it has to be this year.

Cheers!

-PoF

Thanks for the amazing article. This is my first time doing Backdoor, and I was really struggling until I found this post.

In January 2023, I deposited $6000 for 2022 and $6500 for 2023 into a Vanguard Traditional IRA. I earned $10.82 in dividends from Vanguard Federal Money Market Fund and transferred all $12,510.82 to a ROTH IRA.

Two questions:

1. When filing my taxes for 2022, do I include the $10.82 in Form 8606? Or that belongs to 2023? I’m imagining I have to pay taxes for that amount.

2. Does TurboTax help fill out Form 8606? Will it ask for info and file it automatically?

Thank you!

Your 2023 Form 8606 is where the conversion is reported. The Finance Buff Harry Sit has some documentation on Turbotax and Form 8606.

Best,

-PoF

Hello Sir!

Thank you for the detailed description.

I have 2 questions on backdoor conversion after Dec. 31, 2022:

1: HR block said you must have the conversion done before Dec. 31, 2022 for year 2022. What’s your opinion?

2: If you contribute and convert after Dec. 31, 2022, you will not get 1099-R form from the broker (in my case, Vanguard) in time. 1099-R is needed in order to get the 8606 form right, what could we do?

Thank you and much appreciated!

Form 8606 is filled out for the year in which the conversion is made. If you did yours after the 1st of the year in 2023, you’ll report the conversion on your 2023 tax return.

Hello Sir!

Thank you for the detailed description.

I have 2 questions on backdoor conversion after Dec. 31, 2022:

1: HR block said you must have the conversion done before Dec. 31, 2022 for year 2022. What’s your opinion?

2: If you contribute and convert after Dec. 31, 2022, you will not get 1099-R form from the broker (in my case, Vanguard) in time. 1099-R is needed in order to get the 8606 form right, what could we do?

Thank you and much appreciated!

Hello thank you for this tutorial. This is my first time doing the backdoor Roth. I want to contribute for both 2022 and 2023. I have transferred $12,500 to traditional IRA. Do I now convert all of that to Roth at once? How do they distinguish between each year’s contribution?

Thank you for your help

Hello thank you for this tutorial. This is my first time doing the backdoor Roth. I want to contribute for both 2022 and 2023. I have transferred $12,500 to traditional IRA. Do I now convert all of that to Roth at once? How do they distinguish between each year’s contribution?

Thank you for your help

You should be able to convert all at once. You should have designated the tax year for the $6,000 (2022) and $6,500 (2023) when you made the contributions.

Your 2023 Form 8606 should provide the info reporting the tax-free conversions.

Best,

-PoF

Contribute 50 dollars less than the limit to the traditional. It avoids any hassles of dividends etc taking it over the limit when you move the monies to the Roth.

I’d rather “risk” owing a buck or two in tax on the conversion of $6,502.78 or whatever than to have $50 less in the Roth IRA that I could have otherwise had. Just contribute to a money market fund and the interest earned between the time you contribute and the time you convert will be minimal (and there’s no risk of a dividend).

Bset,

-PoF

What do you do about the small amount of interest earned? Do you have to file it on your taxes?

Convert it. Whether there’s interest or not, you’ll report the conversion via IRS Form 8606.

What options do I have with my previous 401k which consist of 360k traditional and 70k Roth. It’s still sitting with my previous employers Vanguard account. I don’t want to roll it over to my new employers 401k since the investments are limited and I don’t want to roll it it an IRA because that will trigger Pro Rata when I do my back door Roth each year. Any suggestions? Thanks!

Leaving it where it is sounds like a nice idea, especially if you’re invested in institutional (low ER) funds and the plan has minimal fees.

Cheers!

-PoF

Thanks for the advice! I followed you’re guide on the back door Roth for 2022 and contributed 6k each for my wife and I. I just did it in 2023 for 2022. Will I get 1099R’s for this or will they come next year since I actually contributed in 2023. I waited to do my taxes this year until I did the Roth conversion. Should I be waiting on these 1099R’s? I am using Turbo Tax and want to report the backdoor Roth.

IRS forms are typically generated for the tax year in which the activity occurred. In the case of the 1099-R, that’s generated when you make the conversion, so I would expect you’ll receive it next January and report it when you file taxes for 2023 next year.

I recommend confirming with a CPA, but that’s my understanding.

Best,

-PoF

Got scared using TurboTax Online because it was taxing the $6K but figured it out with this link. https://ttlc.intuit.com/turbotax-support/en-us/help-article/retirement-benefits/enter-backdoor-roth-ira-conversion/L7gGPjKVY_US_en_US#:~:text=You'll%20receive%20a%20Form,it%20on%20your%202022%20taxes

Did you get this prompt from Vanguard? Should I just accept and move forward?

“A conversion is a taxable event and can’t be changed. If you choose to convert to a Roth IRA, your conversion will be final and can’t be recharacterized. Generally, you’ll owe taxes on the amount you convert from any eligible retirement account into a Roth IRA for that calendar year…..

Did you get this prompt from Vanguard? Should I just accept and move forward?

“A conversion is a taxable event and can’t be changed. If you choose to convert to a Roth IRA, your conversion will be final and can’t be recharacterized. Generally, you’ll owe taxes on the amount you convert from any eligible retirement account into a Roth IRA for that calendar year…..

Hi there, First I really appreciate all of the detail and background you provided. Very helpful!

BUUUT, there is one big glaring omission that may seem obvious but wasn’t to me.

After a lot of waiting and getting frustrated on your step 2, it dawned on me that you never specified that you must have a Traditional IRA account AND a Roth IRA account already opened. The gotcha in your instructions are when you click ‘convert to Roth IRA’ I made the assumption that the account would be opened at that point.

Once I actually opened the Roth account I was able to continue going through your steps and was successful!

So thanks again but I would recommend adding a ‘note’ at the beginning of Step 2 to ensure a user has both traditional and roth accounts already opened.

Hi there, First I really appreciate all of the detail and background you provided. Very helpful!

BUUUT, there is one big glaring omission that may seem obvious but wasn’t to me.

After a lot of waiting and getting frustrated on your step 2, it dawned on me that you never specified that you must have a Traditional IRA account AND a Roth IRA account already opened. The gotcha in your instructions are when you click ‘convert to Roth IRA’ I made the assumption that the account would be opened at that point.

Once I actually opened the Roth account I was able to continue going through your steps and was successful!

So thanks again but I would recommend adding a ‘note’ at the beginning of Step 2 to ensure a user has both traditional and roth accounts already opened.

Sure, I can add that. It probably makes more sense to put in Step 1 where I recommend opening the Traditional IRA.

It’s been more than a decade since I did my first backdoor Roth, and even then, I had an existing Roth IRA opened years earlier when I had lower income and could contribute directly as a resident, so it’s not something I’ve had to think about.

Thanks for the tip!

-PoF

Hey – I’m trying to do this and I was wondering, when initially creating both IRA and Roth IRA accounts in Vanguard for the first time, do you know how to create the Roth IRA account with a 0 balance and essentially not fund it? It seems like it requires at least $1 to create the account. Any tips? Thanks so much!

Thanks for the helpful tutorial!

I followed your instructions for a backdoor Roth through Fidelity, and thought I was all good, but it looks like I “earned” $1.11 in dividends during the few days it took for the money to become available to convert, and this was deposited into the account on December 29th.

Does this mean that I have now triggered the pro rata rule since I had money in a tax-deferred account on December 31st?

No worries. Whether it’s an extra dollar or $100, just convert it all. Tax could be owed on that small portion, but taxes on $1 likely round to zero.

See our Backdoor Roth FAQ for more information.

Cheers!

-PoF

Thank you for this article! In 2023, I contributed the maximum amount to the Traditional IRA for 2023 ($6500). It earned a $22.06 dividend while in the Traditional IRA.

I think I clicked to “convert the entire account.” I don’t know why, but $22.06 didn’t get converted and remains in the Traditional IRA.

If it means anything to you, the Roth IRA transaction history shows Conversion (incoming) as $6522.06, and the Traditional IRA transaction history shows Conversion (outgoing) as -$6522.06.

I believe I can convert the $22.06 to Roth. When I do so, should I or should I not check the box that says “I elect not to have federal and state taxes withheld from this distribution” ?

Thanks for the helpful tutorial!

I followed your instructions for a backdoor Roth through Fidelity, and thought I was all good, but it looks like I “earned” $1.11 in dividends during the few days it took for the money to become available to convert, and this was deposited into the account on December 29th.

Does this mean that I have now triggered the pro rata rule since I had money in a tax-deferred account on December 31st?

No worries. Whether it’s an extra dollar or $100, just convert it all. Tax could be owed on that small portion, but taxes on $1 likely round to zero.

See our Backdoor Roth FAQ for more information.

Cheers!

-PoF

Thanks–but is there an issue since the backdoor Roth was for 2022 and (mostly) converted in 2022? Now that I’ve noticed the $1.11 that was deposited year-end, I’ve converted it, but we’re in a different year and I’m concerned about the reporting since I technically had money in a traditional IRA in 2022 (for essentially one business day).

It’s a rounding error. I suspect it will disappear when you fill out IRS Form 8606. Did you read the FAQ and linked article on the subject?

It’s a rounding error. I suspect it will disappear when you fill out IRS Form 8606. Did you read the FAQ and linked article on the subject?

I did and thought it was just shy of a rounding error, but just remembered that I also converted my 2021 backdoor in 2022, which does make it a rounding error 🙂

Thanks again for the helpful resources!

I did and thought it was just shy of a rounding error, but just remembered that I also converted my 2021 backdoor in 2022, which does make it a rounding error 🙂

Thanks again for the helpful resources!

Hello!

I have both traditional 401k and Roth 401k amounts sitting in my prior employer’s plan (vanguard). Left that employer a couple of years ago.

I’m planning on doing the backdoor $6500 for each of 2022 and 2023 soon – after these are done, can I rollover my existing Roth 401k (~5k) into my Roth IRA and my traditional 401k (~55k) into the traditional IRA that gets set up as part of the backdoor conversion process without being taxed or messing up future backdoors for the upcoming years? Wondering whether the fact that the traditional IRA holds the rollover 401k funds ruins backdoor for me, because if so, I’d move over to my current employer’s 401k…

Thanks!

Hello!

I have both traditional 401k and Roth 401k amounts sitting in my prior employer’s plan (vanguard). Left that employer a couple of years ago.

I’m planning on doing the backdoor $6500 for each of 2022 and 2023 soon – after these are done, can I rollover my existing Roth 401k (~5k) into my Roth IRA and my traditional 401k (~55k) into the traditional IRA that gets set up as part of the backdoor conversion process without being taxed or messing up future backdoors for the upcoming years? Wondering whether the fact that the traditional IRA holds the rollover 401k funds ruins backdoor for me, because if so, I’d move over to my current employer’s 401k…

Thanks!

Having a non-zero tax-deferred IRA balance on 12/31 does cause pro rata issues with any conversions made in that same calendar year.

Best,

-PoF

Thank you! I have this bookmarked for each year and you never fail to keep it up to date, even with the latest Vanguard site changes.

Thank you for the incredible content!

I failed to roll over my traditional IRA to a i401K before 12/31/2022. Am I correct that this forecloses my ability to do a backdoor Roth contribution and conversion in 2023 for tax year 2022 (I haven’t made any tax year 2022 contributions/conversions yet).

Thank you for the incredible content!

I failed to roll over my traditional IRA to a i401K before 12/31/2022. Am I correct that this forecloses my ability to do a backdoor Roth contribution and conversion in 2023 for tax year 2022 (I haven’t made any tax year 2022 contributions/conversions yet).

The pro rata rule applies to the year in which the conversion was done, not the year for which the IRA contribution was made.

I recommend double-checking with a tax professional, but my understanding is that as long as your IRA balance is zero by the end of 2023, any conversion done in 2023 (which could be converting money contributed for 2022 and/or 2023) should not be subject to taxation based on pro rata, since there is no tax-deferred IRA balance to consider.

Cheers!

-PoF

Finally done with postgrad training and for better or worse, I need to do backdoor roths for 2022.

Just created a traditional IRA on my Vanguard. I already have a Roth IRA since residency years.

3 questions:

1) When is the best time to convert to the Roth? Before the year ends or between Jan-Apr of next year (2023) ?

2) Shall I be buying securities (with those $6000) before or after conversion to Roth?

3) (This is a naive question) so every year I make a conversion to Roth, I need to make another traditional IRA that will become another Roth and I accumulate a bunch of accounts every year? Or do they move the converted funds into my original Roth (from residency) and the traditional IRA empties out upon conversion?

Thank you

1) I would do it as soon as you have the funds to do so. Time in the market…

2) After

3) You only need two accounts. The Roth IRA that you have, and the traditional IRA that will have a zero balance almost all year.

Cheers!

-PoF

Thank you so much. So I guess these conversions are basically transfers from traditional IRA to the Roth IRA.

Can I convert only once per tax year? For example, shall I wait until I contributed all of the $6000 before I convert to Roth, or can I convert them to Roth as I contribute to the traditional IRA (let’s say I put in $1500 every month from Sept-Dec, can I convert each $1500 or I have to wait until I am done because I can only convert to Roth once?)

I think it’s best to keep it simple. When you’ve got $6,000 to contribute, put it in the Traditional IRA in a money market fund and convert it to Roth as soon as you’re able.

That’s not the only way to do it, but it’s the cleanest. You won’t have losses in the IRA and gains will be minimal (pennies or a few dollars) and you can convert it all without worrying about the tax consequence.

Cheers!

-PoF

Hi,

My wife and I would like to do backdoor IRAs for the first time in 2022. We have both had traditional IRA’s. I have been able sell all the shares and roll the cash into my employer’s 403 earlier in the year, so now my tIRA account has $0 in it. Am I good to contribute the $6000 then backdoor it this year?

For my spouse, she has only contributed a grand total of $5500 from one previous year, now the account has some unrealized gain and has the value of $5700. She is unable to roll over because her employer does not have a 403. From what I understand, we are better off just paying the taxes on the $5700 and back door the amount in addition to the $6000 that we will contribute this year? Will the gain make the tax form too complicated?

Thanks

Yes, you’re good to go, and your spouse can go ahead and do a Roth conversion on that $5,700 to clear the way to do backdoor Roth contributions this year and in future years, as long as the tax code continues to allow for it.

Cheers!

-PoF

Thanks for your response. Im wondering, for my spouse, since she is not covered by a 401/ 403 at work, is she better off starting a company and put the $5700 from her tIRA into the i401? or is that not worth the leg work?

Best,

PoF, thank you for the excellent resources on this site.

I’m a high-income earner (32% tax bracket) ineligible for Roth IRA contributions except via backdoor Roth. However, I’ve made a mistake with my retirement contributions this year and am now in a sticky spot :

– In January I made a $6k backdoor Roth IRA contribution & conversion.

– In June 2022 I was laid off. I had a traditional 401k with this employer worth about $20k. I didn’t do proper research about the IRS’s pro-rata rule, and – here’s the error – rolled over the 401k balance into my Vanguard traditional IRA. I now have that $20k in pre-tax dollars sitting in my traditional IRA, after already doing my $6k post-tax backdoor Roth conversion this same year.

I understand that neither of these transactions (backdoor Roth conversion or 401k rollover into trad IRA) is reversible, and as a result of my 401k rollover, I’m now liable for taxes on the majority of my backdoor Roth conversion if my traditional IRA still has this $20k in it as of 31 December 2022.

If my next employer allows a reverse rollover – to carry over the original 401k money into their 401k plan, leaving my traditional IRA balance at 0 – I will do that.

If that’s not an option – what are my other options from here? Is the below correct / is there any other path I should consider?

1) I pay tax on the backdoor Roth conversion. I leave the $20k in the traditional IRA. The pro rata rule will be triggered on any future backdoor Roth conversions (not a good option)

2) I convert the entire trad IRA balance of $20k into the Roth IRA. This will trigger around $5k in immediate taxes, but pro rata will not be triggered on future backdoor roth conversions (as long as I don’t have any other IRA assets). (A lot of tax here – also doesn’t seem like a good option)

3) I could set up a solo 401(K) by starting (for example) a survey-answering business, and move the $20k there before the end of the year, so that my traditional IRA balance is 0 by end of December? Is this still an option for me if I regain W-2 employment this year?

Thanks very much for your thoughts on this problem.

You’ve outlined the problem and potential solutions better than I could have! Clearly, you know the situation. You’ve got some time to get the solo 401(k) going.

However, if you’re going to have a low-income year, and you can convert that $20k to Roth at a marginal tax rate of ~25%, that sounds like a pretty good option to me.

Cheers!

-PoF

Thanks for sharing this information. I also planning to back door Roth for the first time. and i don’t have a traditional IRA account, so it will be straightforward for me, but my spouse is unemployed and has a traditional IRA with $50000 that we contributed 6 to 8 years ago. I am not sure if my spouse can open a solo 401(K). Please advise on the simplest way to do back door Roth for my spouse.

Thank you

If she does not have a 401(k) from a previous employer that accepts rollovers, she can either open a solo 401(k) based on some kind of business (walk dogs via Rover, answer surveys for money, other gig economy stuff), or you can pay the taxes on a Roth conversion of that $50,000, which would probably be in the $10,000 to $20,000+ range depending upon your income.

Cheers!

-PoF

I am planning on doing the back door Roth for the first time. Hi.. Doing this for the first time and I guess I messed up a little. I contributed $5500 in July 2008 and after much thinking back and forth, converted it to Backdoor Roth in March 2009 for tax year 2008. The amount has increased to 4Filmyzilla 575. Now I am adding my 1099-R and have no clue. Will appreciate any help on the matter. I used the Finance Buff’s guide to enter 1099R but when it comes to what is your end of yr balance, he has 0 but I had 5555. Please help!!!

I made one way back when they first came out. During the dark days of the market crash I converted a defined contribution pension over to a Roth IRA using a simple call to fidelity.

Too much informatics I was seeking for Angela Ganote Wikipedia

I am planning on doing the back door Roth for the first time. I never had a traditional IRA account, so it will be straightforward for me, but my spouse is unemployed and has a traditional IRA with $5000 that we contributed 3 to 4 years ago. I am not sure if my spouse can open a solo 401(K). Please advise on the simplest way to do back door Roth for my spouse. Thank you

I’m a little confused about what happened during the backdoor process….

My 2022 Trad IRA contribution was 6000.00 and when I converted to the Roth IRA, it shows the contribution to Roth as 6000.05. Did I overcontribute to the Roth? Was the 5 cents just “gains” while sitting in the federal market fund that I need to pay tax on? Or just withdraw from the Roth?

I’m not exactly sure how to handle those 5 pennies and I don’t want to get penalized from it.

Thanks!

Just convert it all. The pennies disappear when IRS Form 8606 is filled out.

Should my balance on my simple ira account be brought to a zero at the time of the backdoor roth transactions or only by the end of the year to avoid pro rata?

By the end of the calendar year.

I am planning on doing the back door Roth for the first time. I never had a traditional IRA account, so it will be straightforward for me, but my spouse is unemployed and has a traditional IRA with $550 that we contributed 3-4 years ago. I am not sure if my spouse can open solo 401(K). Please advise on the simplest way to do back door Roth for my spouse. Thank you

Just do it and convert the $550 along with the new $6,000 non-deductible contribution. You’ll only owe tax on the $550 converted — maybe a couple hundred bucks.

Best,

-PoF

Hello, I’ve been doing the backdoor Roth IRA for myself for a couple years, but have not done it for my wife since she has a Traditional IRA for $4500. She is now stay at home mom, so she is unable to roll it into her 401k. Since it’s a small amount, I want to convert her existing Traditional IRA to Roth this year. If I get that done in April 2022, can I still contribute $6000 and do a backdoor for 2022 Tax Year? Or would I need to wait until Tax Year 2023 (assuming it’s still allowed) before I can make a $6000 backdoor contribution. I want to avoid the pro-rata rule. Thanks!

Yes. As long as the traditional IRA balance is 0 on 12/31/2022, she should be good to go for a tax-free backdoor Roth (after paying the taxes on the conversion of the $4,500.

Best,

-PoF

One thing to note is that the new version of the Balances & Holding page (with white background) does not seem to show the “Convert to Roth IRA” link. Your screenshots show the old version of that page, which you can get to by selecting My Accounts on the top menu bar, and in the drop down menu from My Accounts, select Balances and Holdings.

Once I did that, it displays in the old brown background version of the Balances & Holding page, and the Convert to Roth IRA link is shown. Weird that you have to play with their website to find the link!

P.S. You need some comment spam detection on your blog, many recent comments are just folks promoting their website (generic comment, link to some site you have never heard of)

Thank you for that p.s. I apparently need better Spam detection, as it’s always been on, but I’ve cleaned up those comments now.

As for the screenshots, they should all be from 2022. Perhaps they’ve changed something in the last few months. I rarely spend any time on the initial page with the white background. Selecting “Balances & Holdings” as I show in the beginning takes me where I want to be.

Cheers!

-PoF

HI, Great step by step guide! We have about 250k in the bank doing nothing but collecting dust. We are considering doing this back door conversion through vanguard. Is there a limit you can convert per year? Do you recommend doing a little each year, how much? Husband’s income has been over 200k last 3 years, I don’t work outside house.

You can each do $6,000 per year or $7,000 if age 50 or older.

You’ve got another 5-6 weeks to get it done for 2021, and you can also do it for 2022, so you could put away as much as $24,000 to $28,000 now depending on your age. This assumes that you have no tax-deferred IRAs that would cause pro rata rule issues.

Cheers!

-PoF

Great step by step guide!

Good day. Thanks for everything you provide to our community.

I currently have a SEP IRA Brokerage Account, Individual IRA Brokerage Account, and Roth IRA Brokerage Account with Vanguard.

I want to do my first ever backdoor Roth contribution this year.

I called Vanguard and spoke to a retirement account specialist and he said I don’t have to empty out my SEP IRA by Dec 31 and that I won’t be subject to the pro-rata rule because there will be no “comingled” funds in the accounts.

What he is saying seems to be contrary to what I’m reading here and on other sites.

Assuming I do need to roll over all of my SEP IRA funds to show zero balance on the account on Dec 31, to where can I roll those over?

I currently do have a 401K and cash balance plan (with another brokerage firm) as a solo owner of my medical practice.

Thanks!

The Vanguard rep may have misunderstood, but you absolutely do have a pro rata rule issue if you have tax-deferred money in any IRA.

If your 401(k) plan accepts rollovers, that’s a perfectly acceptable place to accept your SEP IRA and Individual IRA money.

Best,

-PoF

I am planning on doing the back door Roth for the first time. I never had a traditional IRA account, so it will be straightforward for me, but my spouse is unemployed and has a traditional IRA with $5500 that we contributed 3-4 years ago. I am not sure if my spouse can open solo 401(K). Please advise on the simplest way to do back door Roth for my spouse. Thank you

You can convert that $5,500 and pay the tax due on your 2022 tax return next year. That’s the simplest way.

If she has any kind of business, she could open a solo 401(k) and transfer the money there. This would make sense if the business has significant income and she’ll be funding it routinely. Otherwise, it might be more trouble than it’s worth.

Best,

-PoF

Great guide, PoF!

I will definitely be using this when I make my Backdoor Roth contribution for 2022. Now to just save that $5,500 first…

You mean $6,000, right?

My $ is still stuck in the traditional IRA at Vanguard – made the transaction 1/2/22 and officially moved 1/3/22. When I called Vanguard today, they said it takes 7 calendar days to clear before it can be converted to Roth. I don’t know how you did it on 1/5. So frustrating!

Thanks for putting this together and updating it every year! What would this (“there’s a possibility I may have to undo it if Congress forces my hand…”) even look like since conversions are not something you can undo? Any ideas?

They would have to create a way to do undo it.

Sexologist in Delhi is an expert who treats sexual disorders. They are extensively trained in the diagnosis of these disorders. They are trained to diagnose physical problems related to the sexual organs of men or women, or psychological problems that are related to sexual.

I am planning on doing the back door Roth for the first time. I never had a traditional IRA account, so it will be straightforward for me, but my spouse is unemployed and has a traditional IRA with $5500 that we contributed 3-4 years ago. I am not sure if my spouse can open solo 401(K). Please advise on the simplest way to do back door Roth for my spouse. Thank you

The simplest might be to simply convert her $5,500 to a Roth IRA. If it was a tax-deductible contribution initially, you’ll owe taxes on the conversion, but no more than $2,000 at the most, I would bet.

Cheers!

-PoF

FYI – I’m not sure if Vanguard is testing out differences in their user experience, but your initial step for the Brokerage account scenario doesn’t work for me. You write in Brokerage Account Backdoor Roth Step 1: Find your Traditional IRA brokerage account, and click the arrow to the right of “Buy and Sell,” and select “Buy Vanguard funds.”

That just brings me to a buy page where my only option is to pick funds to purchase. To get to the page you show as a screenshot where I am making a contribution, I have to instead select “Contribute to IRA” in that same dropdown menu.

Just figured I’d share in case that was a typo, or something changed.

It could be that they’re doing some A/B testing or that they’ve changed the process since January. I do update this post every year, so if the screens look different for me next year, those changes should be reflected in this post.

Cheers!

-PoF

Thanks for the super informative info! I am someone with funds in a traditional IRA with Vanguard (an old 401k rollover) that have grown over the years. I am allowed to roll them over into my current employer’s 403b so want to clear out the tIRA so I can do a backdoor Roth.

You state, “If you do hold tax-deferred IRA dollars on 12/31 of the calendar year in which you made the Roth conversion, you’ll be subject to taxes when making your conversion per the pro-rata rule.” Does this mean that I should rollover the existing tIRA this calendar year and wait until next calendar year to do the backdoor Roth conversion?

Thanks!

Do you have to open a separate Roth IRA each year to convert your Traditional IRA into when doing the backdoor Roth conversion? Or can you have the $6,000 each year converted and added to the same Roth IRA? I did my first backdoor Roth conversion for 2020. I am now about to convert my 2021 contribution and I don’t know if I can put it in the same Roth account I set for the 2020 contribution or if I need to open a separate Roth account for each year.

With Vanguard, you only need one traditional IRA (which will have a 0 balance almost the entire year) and one Roth IRA that can hold all of your Roth IRA holdings and accept additional money when you make the annual conversion.

Cheers!

-PoF

Hello, so this is my first time doing roth conversion. I opened traditional IRA and only funded $1000 just because I was scared of moving $6000 at once. But now I realize I should just do it all at once and want to add $5000 more to tIRA before converting to Roth. My question is, when I want to add funds to the traditional IRA, how come you choose the “buy vanguard funds” option vs at the bottom of the drop down menu where it says “contribute to IRA”?

Thank you!

I’m guessing either one would give you the same result.

I was told that the IRS does not allow “reverse rollovers” or rolling a Roth IRA into a 401k Roth. Is this true?

I don’t know if that’s true, but note you’ll want to roll Roth 401k to Roth IRA prior to starting RMD’s since RMD’s are required from Roth 401k.

You are correct on both. A traditional IRA can be rolled over into a 401(k) if the plan accepts it (that’s up to the plan administrator), but the only accounty type that can accept a rollover from a Roth IRA is a different Roth IRA. Here’s the answer from the IRS.

Cheers!

-PoF

I was contributing to Traditional IRA for the past 3/4 years and investing directly there. Infact, lost some money on those investments. This year, I added the $6k to the same account and then moved all of the funds (>20k) to Roth IRA. So,question is: any issue in converting $20k Traditional IRA -> Roth IRA in the same year,even though the yearly limits for Traditional IRA contributions were adhered to ?

Hopefully quick question. I know that the guide says that you shouldn’t already have money in the traditional IRA but what if the only other money in the traditional IRA was a non-deductible contribution from last year? Will the conversion then be taxable??

Thank you for the detailed article, it really explains the conversion process!

I have a question about timing. I had a number of annual non-deductible contributions in a traditional ira. I moved the interest/dividends to an active 401k. I had added the $7k contribution for 2020 to the IRA (in 2020) then converted the whole account (all non-deductible and on my 8606) at the beginning of 2021.

So this year, I want to make my 2021 $7k contribution to the traditional IRA but do I have to worry about timing? So 2021 – I made a conversion in January, will a contribution for 2021 effect this such as the pro-rata rule? Not sure that the IRS see the conversion date and the deposit dates. Also, can you do only one conversion per year?

Thanks,

When I go to file taxes – I’m being taxed on the IRA to Roth “re-characterization”! Any ideas?

Form 8606 needs to be filled out correctly. If it is, and you don’t have a pro-rata rule issue due to a tax-deferred IRA, you should not owe money on the conversion (it’s not a recharacterization).

Best,

-PoF

Thank you for the detailed article! My husband and I are considering filing “married filing separately” for 2020 to reduce his monthly payment under his PAYE repayment plan for his medical school loans. However, we would like to also contribute to a Roth IRA but we would exceed the $10k income limits. Does the backdoor method also help bypass the IRS filing status? Cheers!

Hi

If I am doing 2020 and 2021 back door Roth conversion together in 2021, would you recommend two separate conversions one for 2020 and 2021 both in calendar year 2021?

Or

Convert 12000$ in a single transaction from traditional IRA to Roth IRA ? There is no balance in my traditional IRA as of now. Assuming, I contribute 6000$ to 2020 Trad IRA and another 6000$ in 2021 Trad IRA and fill out 8086 form correctly for 2020 and 2021.

I have the same question for this year 2021 with an excess already for 2022. Bobby, did you get a response from a tax advisor or anyone else?

I can’t see any reason for it to matter if it’s one transaction or two, but it might be cleanest to make two separate transactions.

You may want to discuss with your CPA before making the move.

Hi!

I put after tax money on trad IRA in 2020 which had had 0 balance beforehand. If I do backdoor Roth before tax deadline (4/15/21) do I need report it in my taxes for 2020 or for 2021?

Thank you

I want to do a backdoor ROTH IRA conversion but have money in a SEP and traditional IRA already. That business has an employee so I can’t open a solo IRA. Can I create a new business entity so I can open a solo 401k? Can I move an IRA from one entity into a different entities 401k? How about into my wife’s solo 401K?

Thanks for this fantastic article and for going in depth about each step like this.

Re the 2020 Roth contribution, does it have to be invested in funds by 4/15/2021 to “count” toward 2020 contributions, or is simply leaving it in Money Market fund satisfactory?

I know I won’t earn much if anything in the MM account, but I would like to wait for a dip to invest in one of the stock funds.

(I know this isn’t a very ‘Boglehead’ way to do things, but I have been trading for years and I don’t like the euphoria in the market at 3900 SPX and want to wait for a dip.)

It’s when you make the contribution that matters. You don’t have to invest in a mutual fund ever if you don’t want to. You can invest in bonds, bond funds, individual stocks, publicly traded REITs, REIT funds, etc…

Make it a self-directed IRA and you have a whole slew of alternative investments you can invest in within the Roth IRA.

Cheers!

-PoF

Thanks!

I just did this on Vanguard site. The first step was “Contribute to IRA” rather than “Buy Vanguard Funds” when contributing to IRA Brokerage account. Hope this helps others.

Thanks for the wonderful site and information.

I ran into the same thing. Thanks for the help!

I am planning to contribute to back door Roth for the first time. I have a couple of questions. If you can please help, I tried looking for answers but could not find one

1. I live in Connecticut, would CT withhold taxes while converting? I am trying to understand if all of my $6000 will make it to Roth?Or will it be $6000- tax?

2. Would doing this year over year result in multiple Roth IRA accounts? Or does the conversion go to the same account each year we convert. Basically does “convert to Roth” create a new account or the same Roth account is reused?

No, and no.

Just convert to the same Roth IRA year after year.

Best,

-PoF

Thanks for this helpful post! One question about earnings: I accidentally contributed $6k directly into my Roth IRA in January 2020, and made $2k in earnings in my Roth before I recharacterized the $6k + $2k earnings into a traditional IRA this month. When I reconvert these back into my Roth IRA, do I have to pay tax on the $2k in earnings from the initial Roth contribution? I don’t have additional earnings from when my money was parked in my traditional IRA. Thanks!

I must say that’s one I haven’t seen. I’d consult a CPA, but my assumption would be that you would owe taxes on the earnings, since that money should have been parked in a traditional IRA during that timeframe.

I assume you’ll follow the instructions above in 2021 and will no longer have this issue going forward.

Cheers!

-PoF

So I made the mistake of putting in the $6k to the Roth IRA account directly instead of putting it in the Traditional IRA then converting. What do I do to fix this? Thank you.

Recharacterize the contribution. I’d make a phone call to get things squared away.

If your income doesn’t put you into the phaseout range, however, then there would be nothing to do. Many people are allowed to directly contribute.

Best,

-PoF

Is there a step left out?

maybe obvious and if so I apologize but for me it seems I need to create a Roth IRA to transfer the funds into? When I click the “Convert to Roth” I am greeted with a

There are no available accounts for this conversion.

Click OK to be redirected to the Roth Brokerage IRA conversion help page.”

from Vanguard

If you don’t have a Roth IRA yet, you’ll need one. I’ve had one for many years, so I can’t show that screenshot, but you can easily open any account with Vanguard here.

Best,

-PoF

We currently don’t have a backdoor Roth IRA. We have a sizable Vanguard rollover traditional IRA to which we’re currently not contributing from a previous employer years ago. We also have a sizable Vanguard 401(k) to which we’re currently contributing with our present employer. We wish to start contributing to a backdoor Roth IRA in a strategy that minimizes taxable events. Would you suggest moving the money in the Vanguard rollover traditional IRA to the Vanguard 401(k) first and then funding a new Vanguard traditional IRA with money from our checking account (or post-tax income) which we’d then move to a backdoor Roth IRA? Why or why not? Is there another strategy we’re not considering?

That’s exactly what I would do, as long as your current 401(k) accepts rollovers.

Cheers!

-PoF

Thank you for your advice.

Thanks for this resource. I have used it for the past few years. My spouse’s conversion worked just as you described for a brokerage account. For my account – and perhaps I have a “mutual fund account” – I also followed your directions for the brokerage account. After I made the conversion, I was unable to place an order for mutual funds. The next day the whole amount was in the Roth IRA account in a money market fund, and I simply exchanged the funds (I went with VGSLX too- seems like a bargain and I don’t have REIT options in my work- sponsored retirement). So, as you said in another comment above, there seems to be multiple ways to accomplish this. I’ll be back here in a year!

Thanks for sharing your excellent, detailed how-to guide. In my case, my Roth IRA is in a mutual fund account. My traditional IRA is a newer brokerage account. I always have problems converting the traditional IRA balance to the Roth IRA. Initially, I receive a confirmation that the transfer went through. A few days later, I find out that the money “bounced back” into the traditional IRA brokerage account. I end up finishing over the phone with Vanguard. This year, I’m trying online again. I’m still within the 7-day window for the funds to “settle” in my traditional IRA, and it says the funds are unavailable, just like it does in your example. For me, when I ignore that warning and try to do the conversion anyway, it says the amount exceeds the balance. I think this issue is related to the two different account types in use (brokerage vs. mutual fund). The funds should “settle” tomorrow, so I’ll try again then. It also doesn’t help that I have an extra $0.50 left over in the money market fund from last year when it earned a little interest while I worked on the conversion. So now I’m trying to rollover $7000.50, and that 50 cents is taxable. Probably unrelated to the problem, but it’s an extra wrinkle. Wondering if you’ve heard of this issue.

I’m getting the “The amount you entered exceeds this fund’s balance.” error too.

I’m sorry to hear of your troubles, Dan. Vanguard can fix this, but I can’t. My recommendation would be to go ahead and transition the Roth IRA to a mutual fund account since you can’t have a mutual fund traditional IRA account any longer.

It’s not the ideal solution, but it will save you headaches, phone calls, and time when the time comes to do this again in 2022. And they’ll forcibly transition your account sooner or later. Might as well rip off the bandaid yourself.

Best,

-PoF

Thanks for the reply. I think you meant I need to transition my Roth account to a “brokerage” account. I agree. I tried to do that last year, but Vanguard told me there was no direct conversion method available at that time, and I would have to open a whole new Roth account, then move the funds. It turns out that’s not necessary anymore. Today I saw that my transaction went through without bouncing back. Now I just have to figure out the tax on the extra $0.50! 🙂

thanks so much for this…especially the tip on moving forward even though it says “unavailable shares” I was waiting for this to light up before doing the conversion but as you noted, no need to wait!

Never hurts to try. Lo and behold, I was able to do what I wanted to do anyway, in spite of that alert.

Glad it worked out for you, too.

Cheers!

-PoF

Thanks for doing this every year! Just did my fifth back door Roth conversion and third in Vanguard.

Regards,

Ryan

Congrats!

I mainly do it for myself, to be honest. It’s good to have this to look back on each year. The screens change a little from one year to the next, but not much.

Cheers!

-PoF

I think the starting steps may be incorrect. If I follow your instructions of clicking on “Balances and holdings,” then “Buy vanguard funds,” the balance is $0 with no way to add to the account. I can’t get to the screen you start showing us in this tutorial (the screen of “Where’s the money going?” that has a place that shows 2020 and 2021).

Instead, if I go to “My accounts” and “Balances and Holdings,” I can then go to a “Buy and sell” dropdown where I can click “Contribute to IRA.” THAT actually takes me to the starting point of this tutorial.

It depends on which account type you have, and it’s possible that there’s more than one way to get to the same destination within Vanguard’s site.

Reminds me of EPIC, the clunky electronic health record that, in my opinion, is way too customizable. There are a dozen different ways to review labs and other test results, and everyone’s screen looks different. By trying to make it more user-friendly, they made it far too complicated.

It sounds like you were able to do what you needed to do, so I’m glad to hear that.

Cheers!

-PoF

I think you skipped the step where we put the $6000 into the traditional IRA brokerage account in the first place. I have $0 in my account, so mthe first screen of “Where is the money going?” won’t let me do anything because the balance is $0. It says “If you want to contribute using money from outside Vanguard, go to Contribute to IRA.” Did you contribute money to the Traditional IRA first in order to get to setep 1?

Please help.

I’m not sure why I didn’t run into this question last year (2020), but my traditional IRA is a mutual account and my Roth IRA is now a brokerage account holding VTI.

So I’m assuming I’ll need to do an extra step looking like this for this year:

1. fund the $6000 in the traditional IRA’s money market account

2. Choose convert to Roth IRA, but I can’t directly convert into VTI at this step for some reason, can someone please confirm if this is because it’s a brokerage account? My only choice is the settlement account in the Roth IRA for this step.

3. Once transferred (not sure how long the transfer is) to Roth’s settlement account, I’m assuming I will need to immediately convert the $6000 to VTI.

Much thanks for your help in advance.

It took two business days for my brokerage IRA contributions to be available to convert to Roth.

The steps are the same no matter what kind of account you have and with which broker. It’s the timing and screens that will vary.

As far as semantics, in #3 you refer to a “transfer.” That’s your Roth conversion. Once the money is in the Roth IRA, you can invest in whichever fund you like at any time.

Best,

-PoF

I had a similar experience and posted below. It may be that we both have brokerage accounts for the traditional IRA and “mutual fund” accounts for the Roth IRA. I opened my Vanguard Roth when I was a resident <15 years ago, had let it sit untouched for a while, and then started doing back door Roths a few years ago. So my conversion went to a money market, and then I exchanged the funds. It seems to have worked.

Hello,

Thank you for this detailed post with pictures. Incredibly helpful.

I just made a contribution of 6000$ to my Traditional IRA. After this contribution , my basis is around $30k.

In the Tradition IRa- I have a total of around 100k, which is mixture of this basis and pretax money.

Should I first rollover the entire basis of 30k into roth ira and then transfer out the remaining pre-tax money into my work 401k by dec 31st 2021.

Or

Should I first transfer out the pretax money in my IRA into work 401k and then convert the 30k basis into Roth IRa

Does it matter what comes first?

Thank you all you do.

I think it would be cleaner to separate the comingled money first. You’re going to have some earnings from both the pre-tax and non-deductible contributions, and I believe you’ll have to convert and pay tax on the earnings from the non-deductible contributions.

This is a situation where if it were me, I would make some phone calls to my brokerage and 401(k) people to get guidance from them, while also consulting my CPA. It would be easy to goof things up when doing it myself, and then I’d have the headache of undoing what wasn’t done properly.

Best,

-PoF

Thank you!

Thank you for the lightbulb moment! Lol

We are used to funding via the 401k and have had these old Roth’s sitting.

Now they are another vehicle for us high wage earners with not many more options except brokerage accounts with high capital gains taxes.

Hi, I just backdoored $7000 for 2020 and converted for 2020. How do I know if I pay taxes on this amount? So many examples on 8606 online people are not paying taxes.

Isn’t this taxed as ordinary income? Also, what line on the 1040 does this get reported on?

Of course not. I recommend re-reading the post and also reviewing the Backdoor Roth FAQ.

You’re making an after-tax non-deductible contribution and a conversion on that money. It’s post-tax money, and the point of putting it in a Roth account is to prevent taxes on the growth.

Best,

-PoF

Thank you, to clarify Vanguard did not take out the taxes for me . The $7000 was put into a traditional IRA then all $7000 converted to the ROTH. At no point were taxes taken out.

I will not take a deduction but don’t I owe ordinary income taxes on the $7000 now?

You’re never going to be taxed for contributing to an IRA. You either receive a tax deduction for making a traditional, tax-deferred contribution or you make a non-deductible contribution, but there are no taxes for contributing.

Tax-deferred money is taxed when withdrawn from a tax-deferred IRA (or 401(k), 457(b), etc…

I don’t know where the money came from that you contributed, but presumably it was once a higher sum that was taxed as income at some point. It’s post-tax money already.

I hope that makes sense.

Thanks so much for this run-through on the Roth BD conversion. I’ve been doing them for years but it always feels like a painful process every year. One area I get tripped up is the funding process. in your above steps, you said you fund your MM account ahead of time. Is this your MM fund in your brokerage account at Vanguard? Im assuming so, but I thought the funds had to come from the MM fund IN the non-deductible IRA account that I’m funding. So my issue is I always wait to push the money into Vanguard IRA MMF (funding from a savings account) and that money transfer always take a while (3 days or so). If you can fund across different Vanguard account types that would save me some time. ie: fund the Non Deductible IRA via funds transfer from my Vanguard brokerage account MMF. I thought I tried this one year and it didn’t work.

Disregard. I think I found the issue. My IRA is titled in my name (as it should be). Our Vanguard Brokerage is titled in our Trust so it has both my name and my wife’s titled on the account. Vanguard won’t transfer funds between two different titled accounts for IRA funding.

Hi,