The term “passive” has achieved buzzword status when it comes to income and investing. Earn passive income! Passive investing is where it’s at!

As you may have surmised, what it means to do something passively varies mightily from one person to another. Some people refer to the income from their 8 personally-managed rental properties as “passive income.” Sorry, no.

Blogging doesn’t exactly provide passive income, either, nor do a host of other side hustles. So can real estate investing ever qualify as a passive activity?

Dr. Peter Kim has the answer below. This post was originally published on Passive Income MD.

Most people agree that real estate investing is an effective way to create an additional stream of income. But when people start discussing how to invest… well, that’s when the disagreements arise.

Many people are understandably intimidated by the idea of managing multiple properties, finding tenants, and making repairs. They reason that if the goal is truly passive income, then real estate isn’t really an option.

But of course, as with anything, there’s more to the story. After all, there are countless books, blogs, and podcasts that claim that real estate investing can be passive (myself included!).

In today’s post, we’ll be diving into the age-old question: is “passive” real estate investing really passive?

The Real Estate Investing Continuum

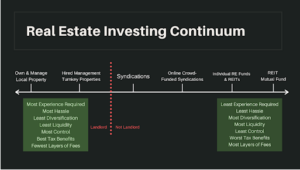

To really understand real estate investing, it’s important to get a zoomed-out view of all the ways you can invest.

As you can see from the chart above (borrowed from this post, which goes into more detail), the ways to invest in real estate exist on a spectrum: the more active methods on the left, the more passive on the right.

Why is this useful? Well, partly because it shows just how diverse real estate is. There are many, many more ways to invest than direct ownership. That alone could be enough to convince certain people that real estate can be a hands-off investment strategy.

But more than that, it highlights that real estate investing can be as passive as you want it to be.

Truly Passive Income

Now, as you might have noticed, the big dividing line between “active” and “passive” is whether or not you take on the role of landlord.

When you invest in other people’s deals and they do all the work, I consider that passive real estate investing.

Crowdfunding and syndications, for example, require virtually no oversight–at least, once you’ve done your due diligence–and can produce excellent returns. Personally, I think both of these are great ways to dip your toe into the world of real estate investing.

Of course, even further to the right, you have REITs. Like stocks, REITs allow you to simply invest some money and then let it increase in value. The downside is that REITs are strongly correlated to the public market, and as a result, are subject to some volatility and may not provide true diversification.

The benefit of all of these is that they are truly passive. You don’t need to worry about the properties directly at all. No phone calls and no decisions to make.

So What’s the Catch?

If passive real estate investing is so amazing, why would anyone want to own rental properties? Well, when you own the asset, you have total control of what to do with the property.

Do you want to paint it? Do you want to increase the rent? Do you want to sell the property? Do you want to pass it to your kids?

When you invest in passive real estate investments you give up control. Someone operates the deal and you’re along for the ride as a limited partner.

Also, when someone else is running & operating the deal, they have to get paid and be incentivized for creating the opportunity for everyone. So there are fees and a profit split.

So you’re essentially giving up potentially higher returns and control for the benefit of more time when you decide to invest in passive real estate.

My Experience

I’ve personally invested in nearly 30 deals over the past 7 years and I can honestly say that the total amount of time I’ve spent collectively on all 30 deals after the initial due diligence period comes out to less than a few hours.

When I receive quarterly updates, I read the reports and look for my dividends. I receive a K1 for the year reflecting my ownership stake and I forward that to my CPA. That’s about it.

All of the work comes on the front end of the deal when you’re performing your due diligence of the sponsor and the deal. It used to take me days to evaluate an offering. I had to cobble together info from a few books and from whatever I could find online. Honestly, it took several years of investing to feel confident in my decisions.

However, as I began to gain more experience and figure out a basic roadmap for how to evaluate these deals, those “days” shrunk into “hours.”

So now the income / time ratio continues to grow… more income for less time. That’s my definition of passive income.

Physicians and pharmacists, Register with Incrowd for the opportunity to earn easy money with quick "microsurveys" tailored to your specialty.

Conclusion

Ultimately, the answer to the question of whether passive real estate investing is really passive is simple…Yes!

If you’re looking for an opportunity where you’re willing to put in the time and effort to maximize returns, then you might do better with direct ownership. I do invest in properties but I only allocate a portion of my time to it.

However, if your primary goal is to protect your time and use it in different ways than managing an investment, then passive real estate investing sounds like it might be a great option for you.

Do you agree? How many hours have you put into your passive real estate investing? Comment below!

6 thoughts on “Is Passive Real Estate Investing Really Passive?”

I think it’s good to point out the fact that passive income can be defined so many ways. Some people that start businesses or buy homes have an upfront commitment yes, but how passive is it on an ongoing basis? Dividend and RE syndication deals or crowdfunding are great ways for passive FI, and I think other ways are surfacing, such as creating an e-book and enjoying sales well past once you’ve published it.

Oh gosh, I started out doing single family rentals by looking for deals and then hiring a property manager. For me, that was far from passive as I had to manage the managers for years and years.

I’ve finally sold all my rentals as of last year and are fully invested in syndications instead. It’s much easier to take a few hours to read a financial statement and plop the money down that to deal with headaches constantly (or have the background anxiety that a pipe will burst or something like that). Plus, after 3 years investing in syndications, some deals seem to be finally exiting this year.

I love reading your posts! This one is so true and so crucial and I’m just beginning to learn that. Failure is definitely not an option and as I learn, I can’t wait to gain more readership and for the blog to grow!

handbags

nice tips and it was really great for me

REIT ETFs have been my preferred method for investing in RE due to their passive nature and diversification benefits. While I give up higher potential returns, I also decrease my downside exposure of syndications going under, etc., since I buy the whole index. Regarding tax benefits, REIT ETFs benefit from the Tax Cuts & Jobs Act of 2017 and allow for the first 20% of dividends to pass through to the owner tax-free.

So, not only do REIT owners benefit from no taxation on the corporate level, but they also benefit from reduced taxes on the individual level in after-tax accounts.

As a current landlord who is slowly reducing his portfolio and shifting that money into syndicated deals, I can tell you I sleep better at night with the more passive investments. Sure I’m not making 30%+ IRRs like I have with some of the rentals I’ve sold, but I’m able to deploy more capital and diversify better through syndications. And at least for me, even though being a landlord doesn’t take a ton of time, it is an unconscious stressor always in the back of my mind.

There is no right or wrong answer, and it depends on the person. For me, rentals were a great way to grow wealth quickly when I was younger and had more time and mental capacity. Now with kids, a full time job, and other side hustles, I value my time and brain space more than the extra returns.